Sustainability reporting between past and future: how should companies proceed?

In recent years, sustainability reporting in Europe has undergone a profound regulatory transformation. From the NFRD (Non-Financial Reporting Directive, 2014/95/EU), which required Public Interest Entities to disclose non-financial information, we have moved on to the CSRD (Corporate Sustainability Reporting Directive, EU 2022/2464), a directive that introduced ESRS as the European reference standard and changed the parameters of sustainability reporting.

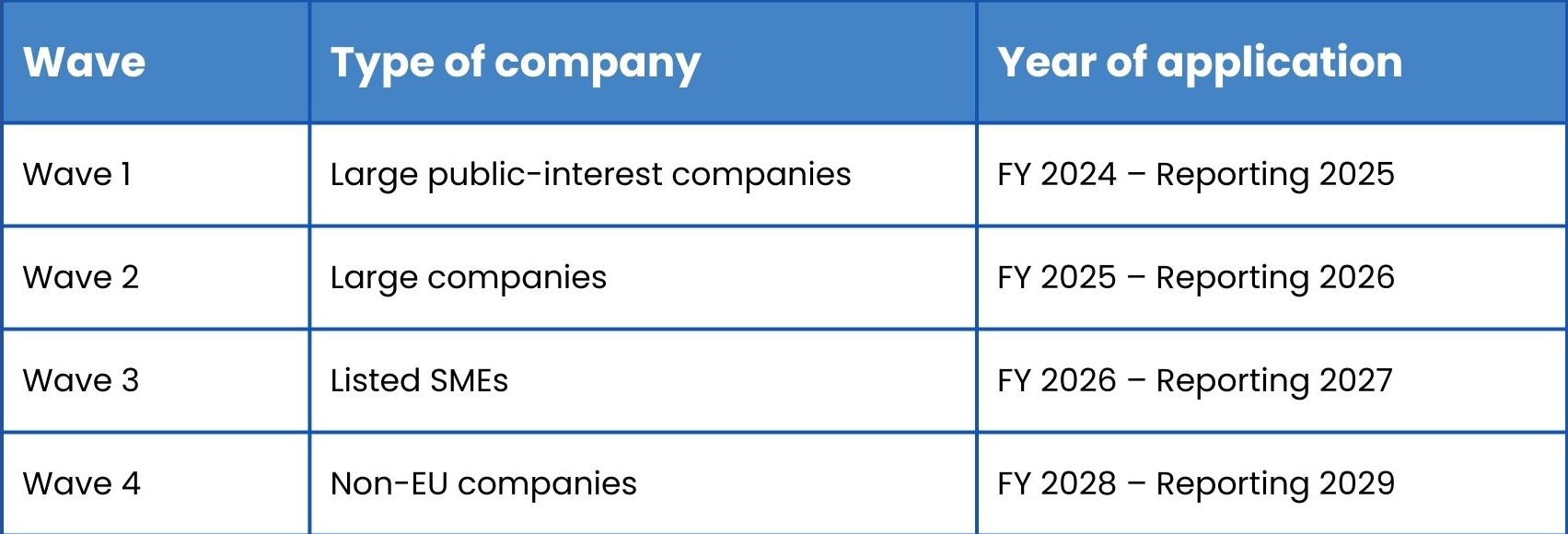

At the beginning of 2025, the regulatory framework on sustainability reporting underwent a significant revision: with the aim of reducing administrative burdens and strengthening the competitiveness of the Union, the European Commission presented the Omnibus Package, which intervenes structurally on the CSRD, redefining the timing of application and scope of reporting obligations for the different categories of “Wave” companies.

Table 1: Original timetable for the application of the CSRD Directive (“Waves”) by type of company

The Omnibus package, presented in February 2025 by the European Commission, contained two main legislative proposals:

- COM(2025)80: temporary postponement of reporting obligations (“stop the clock” mechanism);

- COM(2025)81: substantial revision of the scope of application of the CSRD.

On the first front, the stop-the-clock measure became operational with the entry into force, on 17 April 2025, of Directive (EU) 2025/794, transposed in Italy by Law No. 118 of 8 August 2025. Through this measure, the European Union has postponed the entry into force of the reporting obligations under the CSRD for companies not yet subject to it by two years, giving companies more time to prepare for the application of the ESRS.

Table 2: Timeline for the application of the CSRD Directive after the publication of the stop-the-clock (“Waves”) by type of company

On the second front, on 16 December 2025, the European Parliament definitively approved the new thresholds for the application of the Directive.

The reform introduces the following size thresholds:

Table 3: Thresholds for application of the CSRD Directive following approval of the Omnibus Package by type of enterprise

The new scope of application is expected to come into effect in 2028 with reference to FY 2027, in line with the postponement introduced by the stop-the-clock mechanism.

In conjunction with the revision of the CSRD, EFRAG, commissioned by the European Commission, published the Exposure Drafts of the Revised ESRS at the end of November with the aim of simplifying the first set of ESRS. Final adoption is expected in the first quarter of 2026.

The main areas of intervention concern both structural and formal changes, aimed at making the ESRS clearer and more accessible, and substantial changes in content and reporting requirements. Among the main changes are:

- elimination of voluntary data points and reduction of mandatory data points (-61%);

- elimination of sub-sub-topics;

- reorganisation of the text with application requirements placed immediately after the relevant paragraphs;

- elimination of specific sectoral standards;

- new approach to double materiality inspired by the “fair presentation” framework;

- application of a top-down approach for the identification of IROs;

- introduction of the principle of disproportionate costs and efforts.

As part of the Omnibus, the Commission also intervened with the Quick-Fix Regulation (July 2025) aimed at Wave 1 companies, which are required to report as early as FY 2024 and were excluded from Stop-the-Clock.

The intervention reduces the initial burdens and increases certainty of application without altering the structure of the standards: for the 2025-2026 financial years, it largely extends the transitional flexibilities provided for in the original version of the ESRS to companies with more than 750 employees and allows certain specific information (including environmental risks and opportunities, certain social profiles of the workforce and Scope 3 reporting) to be postponed until 2027, without prejudice to the obligation to provide summary information where the thematic standard is material.

In light of this rapidly changing landscape characterised by such significant changes, what operational guidelines should European companies follow today for sustainability reporting?

Wave 1 companies: what to do today

Wave 1 companies that have already been required to report for FY 2024 based on the original version of the ESRS, if they fall below the new thresholds, remain subject to reporting requirements for the 2025 and 2026 financial years, unless their Member States introduce an early exemption regime at national level. In any case, the possibility of benefiting from the flexibilities introduced by the Quick-Fix Regulation remains valid.

For these companies, it will be important to continue along the path they have embarked upon, in particular by:

- consolidating data collection and validation processes;

- defining reporting priorities that go beyond mere legislative compliance;

- monitoring the evolution of the Revised ESRS in order to progressively adapt their reporting systems.

For “above-threshold” companies that also fall within the new scope of the CSRD, it will be necessary to:

- continue to develop and invest in the most relevant sustainability measures;

- streamline their data collection processes within the limits set by the new ESRS, particularly along the value chain;

- integrate sustainability into governance processes, with clear responsibilities and periodic reviews.

Companies not falling within the scope of the CSRD

With the approval of the Omnibus Package and the introduction of new size thresholds, a significant proportion of companies that, according to the original CSRD framework, would have fallen under Waves 2 and 3 are now excluded from the sustainability reporting obligation.

For these companies, reporting does not disappear, but changes radically in nature: from regulatory compliance, it becomes a strategic choice, increasingly relevant in responding to the demands of customers, financial institutions, partners and stakeholders.

In this context, it is appropriate to develop or consolidate the most strategic sustainability elements, including:

- a strategic approach to sustainability, recognising the value of competitiveness and not just legislative compliance;

- the development of policies, actions and objectives related to the main ESG impacts;

- the calculation of the organization’s carbon footprint and the development of climate transition plans, even in simplified form, to respond to growing demands for climate risk management.

With regard to reporting frameworks:

- The GRI Standards represent the most comprehensive and internationally recognised framework. They are particularly suitable for companies that have already embarked on a structured sustainability path, have established minimum processes in place and intend to maintain in-depth, comparable and credible reporting to the market.

- VSMEs, voluntary standards inspired by ESRS and designed for SMEs, offer a proportionate and scalable approach. They allow reporting to be started from a basic set of information, reducing operational burdens and leaving room for progressive evolution over time.

- The updated ESRS, although not yet officially approved, will represent a significant alternative, given their institutional value and adoption by larger companies.

For many companies excluded from the CSRD scope, particularly smaller ones or those with a leaner organizational structure, the adoption of VSMEs is an effective starting point, allowing them to define boundaries, responsibilities and fundamental datasets and to progressively build a more mature reporting system.

A redefined scenario

After a period of uncertainty characterised by regulatory review lasting almost a year, the approval of the Omnibus Package marked the achievement of a new and desired state of certainty for the European sustainability reporting landscape. The obligation has significantly reduced the number of companies subject to the CSRD Directive and reduced reporting requirements, but sustainability remains a key factor in competitiveness and transparency.

For companies, there is now an even greater opportunity to interpret sustainability not primarily as a response to a regulatory obligation, but as a strategic lever to position themselves better in a market context where sustainability challenges remain real and cannot be postponed.

Discover how our solution can support you on your path to sustainability: discover YEP!